Kyrgyzstan Insurance Industry – Key Trends and Opportunities to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Kyrgyzstan Insurance Market Report Overview

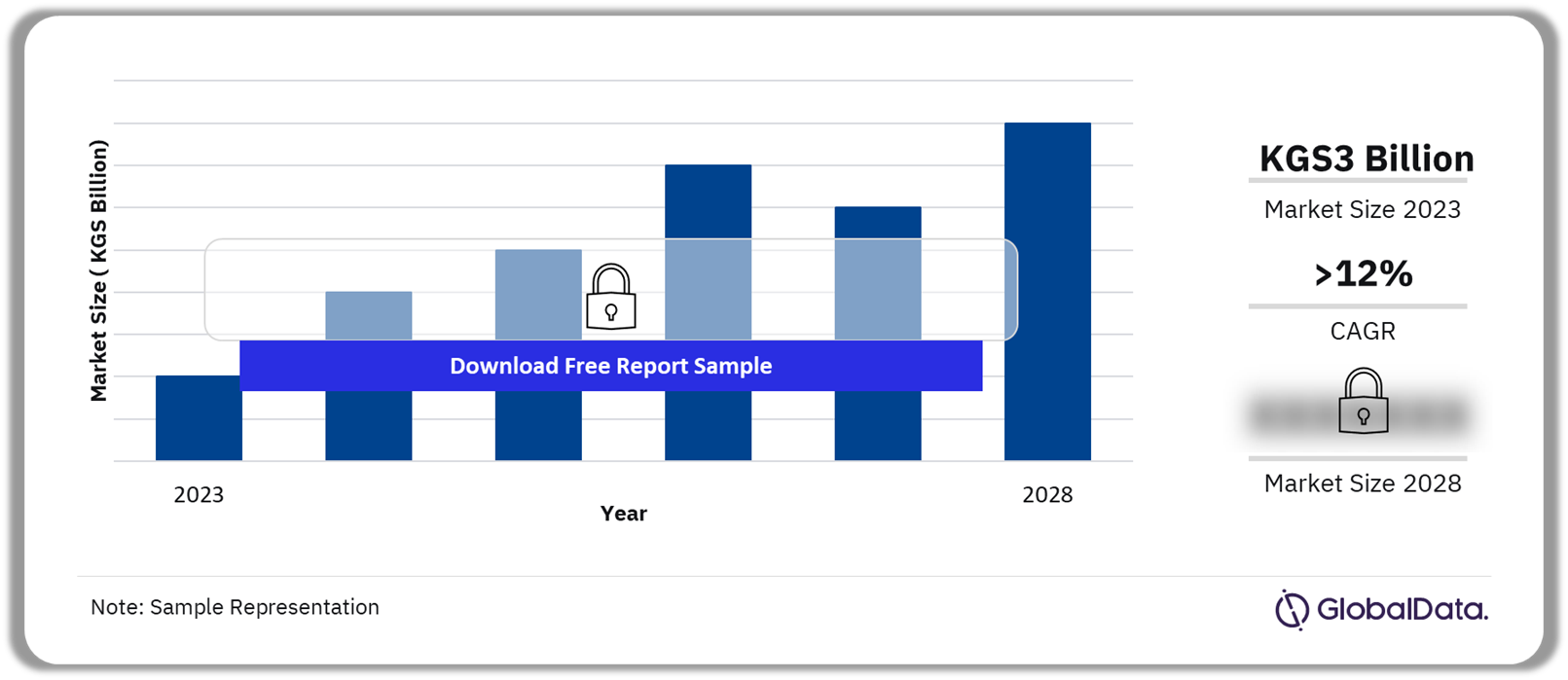

The gross written premium of the Kyrgyzstan insurance market was KGS3 billion ($34.7 million) in 2023. The market will achieve a CAGR of more than 12% during 2024-2028. The Kyrgyzstan insurance market research report provides in-depth market analysis, information, and insights into the Kyrgyzstan insurance industry. It provides a detailed outlook by product category as well as values for key performance indicators such as gross written premium, penetration, premium accepted and ceded, profitability ratios, and premium by line of business, during the review and forecast periods.

Kyrgyzstan Insurance Market Outlook, 2023-2028 (KGS Billion)

Buy the Full Report for More Insights into the Kyrgyzstan Insurance Market Forecast

The Kyrgyzstan insurance market report also gives a comprehensive overview of the Kyrgyzstan economy and demographics. It further evaluates the competitive landscape, which entails information on segment dynamics, competitive advantages, and profiles of insurers operating in the country. The report also includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2023) | KGS3 billion ($34.7 million) |

| CAGR (2024-2028) | >12% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Segments | · General Insurance

· Life Insurance |

| Key Lines of Business (GI) | · Property

· Liability · General Insurance PA&H |

| Leading Companies | · NSK Insurance

· Ayu Garant Insurance · IC Alma Insurance · ATN Policy Insurance · GSO |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Kyrgyzstan Insurance Market Trends

Market trends in medical insurance and motor insurance are significantly impacting the Kyrgyzstan insurance market.

- In February 2023, a new law regarding health insurance became mandatory for all citizens in Kyrgyzstan, including foreign citizens and students studying in the country.

Buy the Full Report for More Insights on Trends Shaping the Kyrgyzstan Insurance Market

Download a Free Report Sample

Kyrgyzstan Insurance Market by Segments

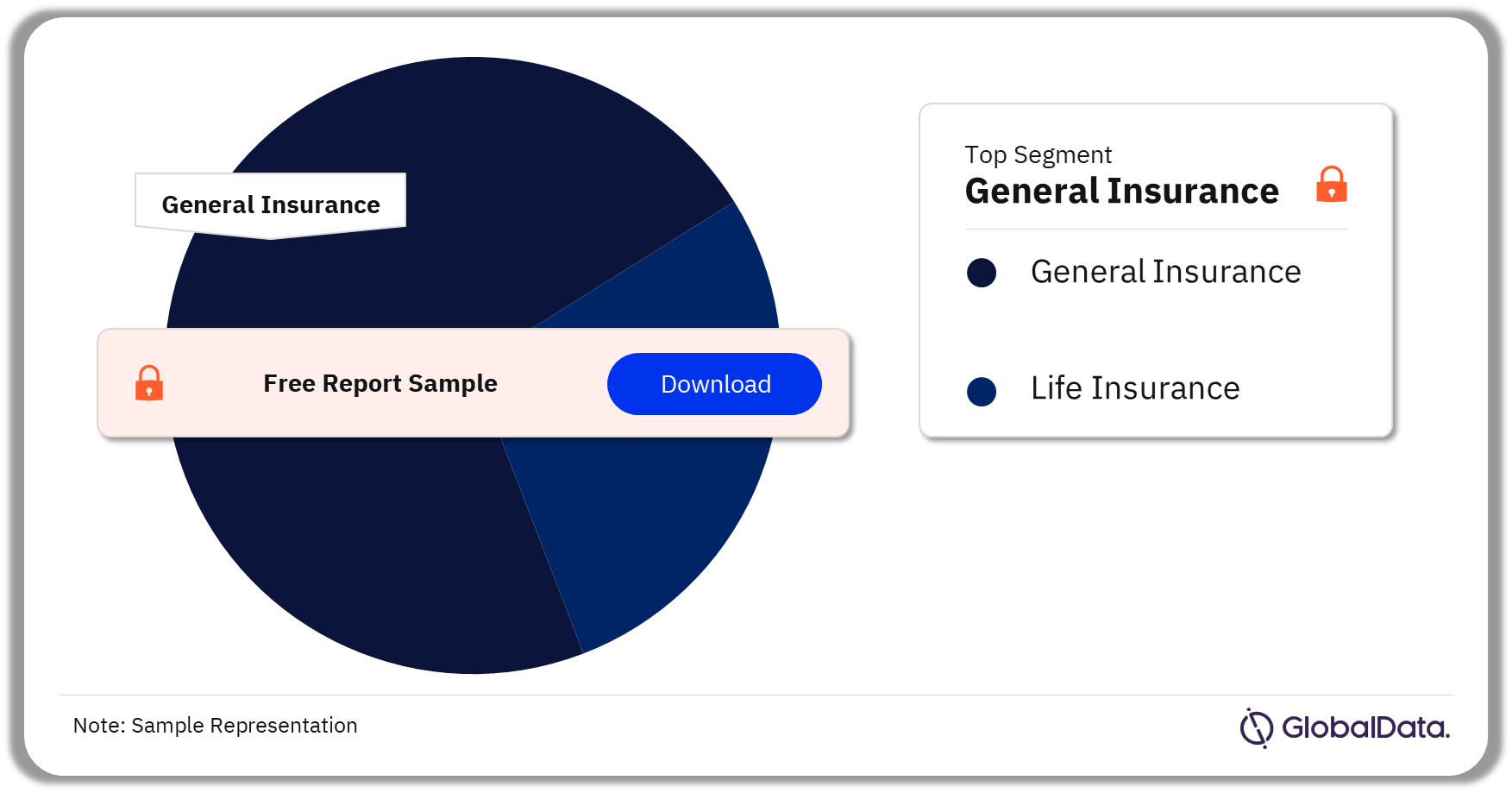

In 2023, the general insurance segment accounted for the largest share of the Kyrgyzstan insurance market

The key segments in the Kyrgyzstan insurance market are life insurance and general insurance. The general insurance segment dominated the Kyrgyzstan insurance market in 2023. The key lines of business in the Kyrgyzstan general insurance market are property, motor, liability, financial lines, MAT, general insurance PA&H, and miscellaneous. Property insurance was the dominant line of business in 2023.

Kyrgyzstan Insurance Market Analysis by Segments, 2023 (%)

Buy the Full Report for More Segment Insights into the Kyrgyzstan Insurance Market

Download a Free Report Sample

Kyrgyzstan Insurance Market – Competitive Landscape

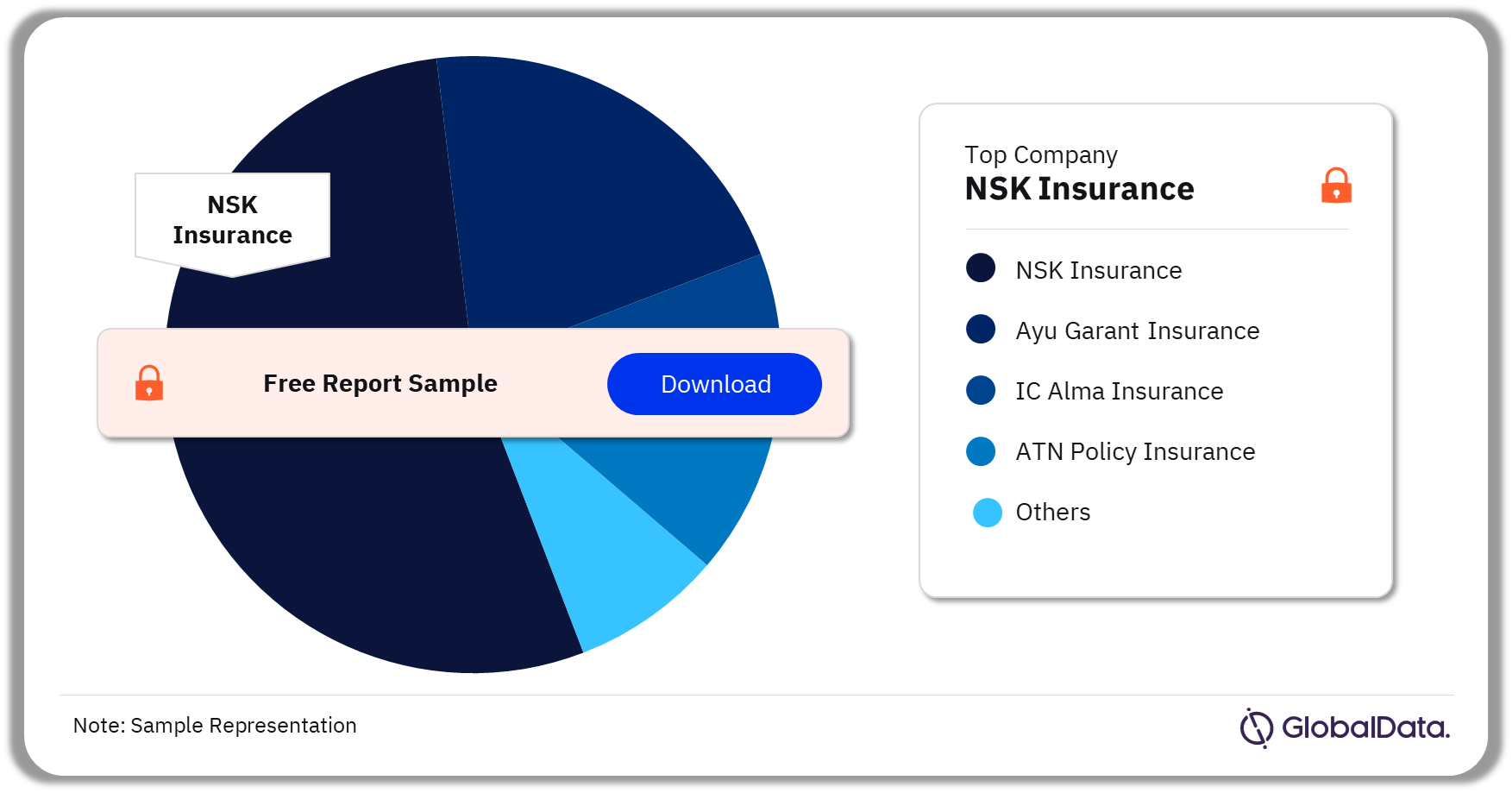

In 2023, NSK Insurance accounted for the highest share of the Kyrgyzstan general insurance market

A few of the leading companies in the Kyrgyzstan general insurance market are:

- NSK Insurance

- Ayu Garant Insurance

- IC Alma Insurance

- ATN Policy Insurance

- GSO

Kyrgyzstan General Insurance Market Analysis by Companies, 2023(%)

Buy the Full Report for More Company Insights into the Kyrgyzstan Insurance Market

Download a Free Report Sample

Kyrgyzstan Insurance Market – Latest Developments

- On January 30, 2024, the Financial Action Task Force issued a report detailing Kyrgyzstan’s progress in strengthening its anti-money laundering and counter-terrorist financing measures. The report, including re-ratings, reflects the country’s efforts to address technical compliance deficiencies and align with new FATF recommendations.

- In February 2023, a new law regarding health insurance became mandatory for all citizens in Kyrgyzstan, including foreign citizens and students studying in the country. Citizens over 16 years old without medical insurance must buy a mandatory medical insurance certificate. However, the state will provide insurance for socially vulnerable groups, students under 21, and children under 16 (or up to 18 if still in school).

Segments Covered in the Report

Kyrgyzstan Insurance Market Segments Outlook (Value, KGS Billion, 2019-2028)

- Life Insurance

- General Insurance

Kyrgyzstan Insurance Lines of Business Outlook (Value, KGS Billion, 2019-2028)

- Property

- Liability

- General Insurance PA&H

Scope

This report provides:

- A comprehensive analysis of the Kyrgyzstan insurance industry

- Historical values for the Kyrgyzstan insurance industry for the review period, 2019-2023, and projected figures for the forecast period, 2024-2028.

- A detailed analysis of the key categories in the Kyrgyzstan insurance industry and market forecasts up to 2028.

- Profiles of the top life insurance companies in Kyrgyzstan and outlines the key regulations affecting them.

Key Highlights

• Key insights and dynamics of the Kyrgyzstan insurance industry.

• A comprehensive overview of the Kyrgyzstan economy, government initiatives, and investment opportunities.

• The Kyrgyzstan insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

• The Kyrgyzstan insurance industry’s market structure giving details of lines of business.

• Kyrgyzstan’s reinsurance business’s market structure giving details of premium ceded along with cession rates.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to the Kyrgyzstan insurance industry, and each category within it.

- Understand the demand-side dynamics, key market trends, and growth opportunities in the Kyrgyzstan insurance industry.

- Assess the competitive dynamics in the Kyrgyzstan insurance industry.

- Identify growth opportunities and market dynamics in key product categories.

Arsenal-Kyrgyzstan Insurance

Jubilee Kyrgyzstan Insurance

Ayu Garant Insurance

IC Alma Insurance

ATN Policy Insurance

Kyrgyzstan Insurance

A Plus Insurance

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Kyrgyzstan insurance market gross written premium in 2023?

The gross written premium of the Kyrgyzstan insurance market was KGS3 billion ($34.7 million) in 2023.

-

What will the growth rate of the Kyrgyzstan insurance market be during the forecast period?

The insurance market in Kyrgyzstan will achieve a CAGR of more than 12% during 2024-2028.

-

Which segment dominated the Kyrgyzstan insurance market in 2023?

The general insurance segment accounted for the largest share of the Kyrgyzstan insurance market in 2023.

-

Which are the leading companies operating in the Kyrgyzstan insurance market?

A few of the leading companies in the Kyrgyzstan insurance market are NSK Insurance, Ayu Garant Insurance, IC Alma Insurance, ATN Policy Insurance, and GSO.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports